Government waives penalty on delayed filing of August, September GST returns

The Finance Minister also clarified that late fee charged to businesses will be credited back

In a major relief to businesses across the country, the government on Tuesday waived the penalty on delayed filing of initial GST returns for the month of August and September.

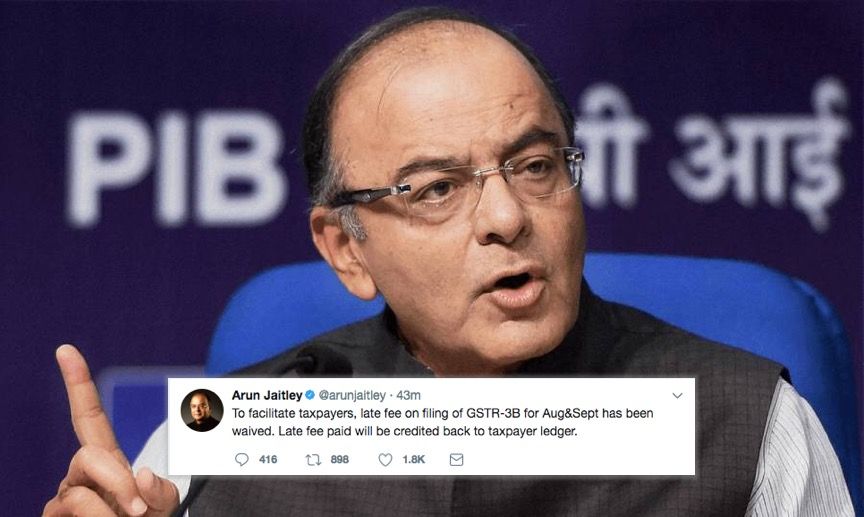

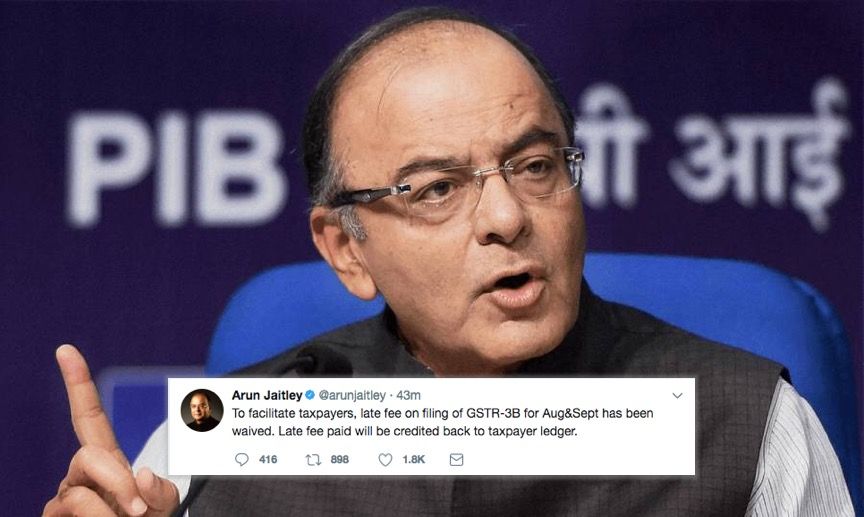

“To facilitate taxpayers, late fee on filing of GSTR-3B for August and September has been has been waived,” Finance Minister Arun Jaitley tweeted.

He said that the late fee which has been already charged to businesses will be credited back to taxpayers’ accounts.

To facilitate taxpayers, late fee on filing of GSTR-3B for Aug&Sept has been waived. Late fee paid will be credited back to taxpayer ledger.

— Arun Jaitley (@arunjaitley) October 24, 2017

The government had earlier waived late fee for delayed filing of the maiden returns for the month of July under the Goods and Services Tax (GST) regime.

Businesses have been demanding that the government waives penalty for delayed filing of 3B returns.

As per the data, 55.87 lakh GSTR-3B returns were filed for July, 51.37 lakh for August and over 42 lakh for September. Preliminary returns GSTR-3B for a month is filed on the 20th day of the next month after paying due taxes.

According to GST Network (GSTN) data, a huge chunk of businesses file their returns after the expiry of the due date.

While only 33.98 lakh July returns were filed till the due date, the number has now gone up to 55.87 lakh. Similarly for August 28.46 lakh returns were filed till the last date, but the figure went up to 51.37 lakh later.

Also for September while 39.4 lakh returns were filed by the due date, the number is rising and was over 42 lakh till yesterday.

The GST law provides for a nominal fee of Rs 100 per day on Central GST and an equivalent amount on State GST in case of late filing of returns and payment of taxes.

The government, under criticism from certain sectors and opposition, is also working on reviewing the applicable tax rates on goods & services.

With PTI inputs