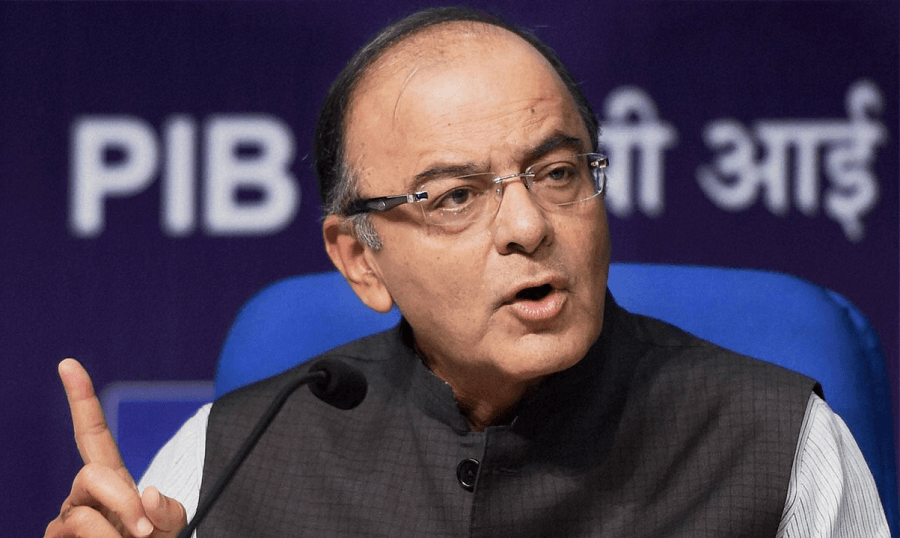

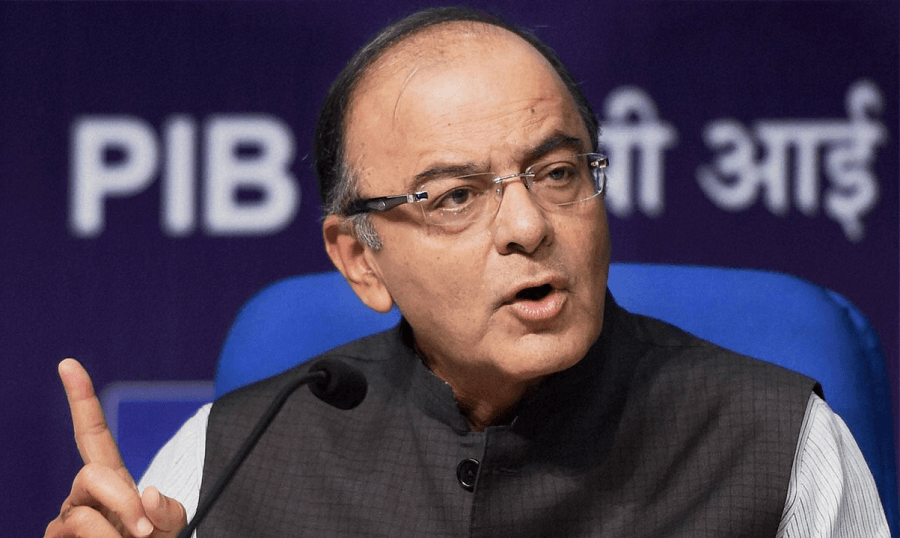

GST will have to be implemented between Apr 1 to Sep 16: FM Arun Jaitley

Finance Minister Arun Jaitley

Goods and Services Tax (GST) will have to be be implemented between April 1 and September 16, 2017 owing to constitutional compulsions, Finance Minister Arun Jaitley said on Saturday.

“The range of timing when GST has to come into force is between April 1 and September 16, 2017 due to constitutional necessity. Nobody has the luxury of time,” Jaitley said in his address at the 89th annual general meeting of Federation of Indian Chambers of Commerce and Industry (FICCI) in New Delhi today.

The Constitution (One Hundred and First Amendment) Act, 2016 was notified on September 16 for GST come into force within a period of one year.

“So on September 16, 2017, as far as the current mode of taxation is concerned, the curtains will be down and nor the Centre or states can go in for taxation under the current regime,” Jaitley added.

“Ideally GST should come into effect from April 1, 2017. The earlier we do it, the better it is to adapt to the new system,” he said.

The Finance Minister said that the Central GST, Integrated GST and state compensation matter for revenue losses bills are currently in the process of getting drafted. All of them will need to be passed by the Parliament.

“The GST council now has to take vital decisions. I don’t see any difficulty in getting these bills passed. The only issue is of assessee jurisdiction,” he said.

Jaitley said one of the most crucial issue which needs to be resolved in the Council pertains to who, Centre or State, will exercise control over GST assessees. Although he clarified that each assessee will be assessed only once.

“How this burden is going to be shared between the states and Centre. With the parallel set-ups in place. It has to lead to federal bureaucracy, but it is still a far cry. So it is a small issue and we are trying to resolve it,” he added.