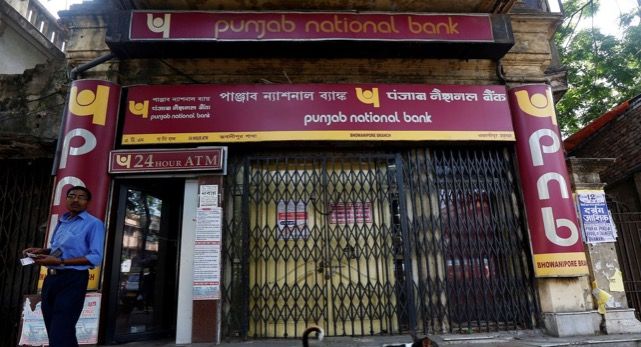

PNB responds to Nirav Modi’s allegations, adopts stricter SWIFT controls

PNB has adopted stricter SWIFT controls after the scam (Representational Image, Courtesy: MSN)

Punjab National Bank (PNB) on Thursday hit back at billionaire jeweller Nirav Modi, who had accused the bank of closing possible avenues of recovering dues by going public.

The bank refuted his claims and said that it had followed lawful avenues to recover dues.

“Nirav Modi said PNB closed all options to recover dues by going public. However, we have followed lawful avenues available to us as per law of land to recover our dues,” the company secretary Balbir Singh said in a statement.

The bank, while responding to a query regarding the quantum amount of fraud, said the total amount was Rs. 11,394.02 crore, which was notified to relevant authorities on February 13 itself.

“On February 5, we, on the basis of the preliminary investigation report, informed simultaneously to our Board as well as to the BSE and NSE of initial fraud case of Rs. 280.70 crore. Upon receiving further investigation report enhancing the fraud amount to Rs. 11,394.02 crore or USD 1.77 billion, the Reserve Bank of India (RBI), and Central Bureau of Investigation (CBI) were informed in the evening of February 13. Information was also sent to the BSE and NSE on February 14,” the statement said.

Responding to allegations of the bank’s failure to report the filing of an FIR with the CBI at the occurrence of the event, PNB clarified that since law enforcing agencies were assigned to investigate the matter, any news in public would have alerted the fraudster, thereby affecting recovery.

The PNB also assured that enough assets and capital was available “to meet any liability which is decided as per law.”

Stricter SWIFT controls

Meanwhile, the bank has also stepped up its controls on the use of global payments network SWIFT in the backdrop of the scam, reported Reuters.

The fraud was facilitated by PNB officials at the bank’s Brady House branch in Mumbai, who issued unauthorised ‘letters of undertaking’ (LOU) via SWIFT, for firms linked to Nirav Modi and Gitanjali Gems Chairman Mehul Choksi.

The undertakings, issued between 2011 and 2017 with incomplete ledger entries by officials, were used by duo’s firms to obtain credit from the overseas branches of mostly Indian lenders.

Going forward, only PNB officers will be able to initiate messages on SWIFT, taking away the authority of clerks. Several new limits have been placed on the amount that officers can generate depending on their seniority in the bank hierarchy.

The note sent by the bank’s head office in New Delhi to all regional offices last week also stated any SWIFT message will have to be created, verified and authorised by three different officers, starting Thursday. Earlier, two individuals were needed for the process.

“In continuation of efforts to strengthen SWIFT operation and deploy additional measures to ensure more effective control, it has been decided to set up SWIFT user base limits,” the note said.

The bank has also created a unit called ‘Treasury Division Mumbai’ for re-authorisation of most messages – including those for LoUs – sent over SWIFT by branches. Any rejection due to mismatch will be kept on record for audit by auditors.

Earlier today, the Enforcement Directorate seized nine luxury cars owned by Nirav Modi and his group companies in connection with its ongoing investigation.

It also froze shares and mutual funds worth Rs 7.8 crore of Nirav Modi and Rs 86.72 crore of Mehul Choksi’s group.