Government cuts excise duty on petrol & diesel by Rs 2, petrol falls to Rs 77.5 in Mumbai

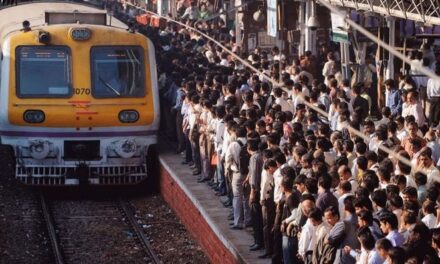

The government levies excise duties totalling Rs 21.48 per litre on petrol and Rs 17.33 per litre on diesel (Representational Image. Courtesy: AFP)

After weeks of criticism, the government on Tuesday cut the excise duty on petrol and diesel by Rs 2 per litre to offset the continual rise in fuel prices over the last three months.

“Govt of India has reduced Basic Excise Duty rate on petrol and diesel [both branded and unbranded] by Rs 2 per litre w.e.f. 4th October,2017 (sic),” the finance ministry said in a tweet.

Prices of petrol and diesel will be reduced by the amount of duty cut with effect from Wednesday. Petrol earlier cost Rs 70.88 per litre in Delhi while a litre of diesel is priced at Rs 59.14, the highest ever.

After the reduction, the price of petrol has come down to Rs 77.51 per litre and diesel to Rs 60.43 per litre in Mumbai.

On petrol, the government levies excise duties totalling Rs 21.48 per litre while that on diesel is Rs 17.33 per litre.

The government, which had raised duties three years back to take away gains arising from plummeting global oil prices, has been criticised for not cutting excise duty despite a sustained rise in fuel prices since early July.

Petrol price has jumped by Rs 7.8 per litre since 4 July, while diesel rates have touched an all-time high after rates went up by Rs 5.7.

“This (excise duty cut) has been done to cushion the impact of rising international prices of crude petroleum oil and petrol and diesel on their retail sale prices,” it said in another tweet.

The duty reduction will lead to a Rs 13,000 crore loss of revenue to the government during the remaining period of the fiscal.

According to Aditi Nayar, principal economist at ICRA, state governments will also lose revenue since many of them impose VAT – in the range of 25-40 percent on petrol and 15-25 percent on diesel – on fuels.

Incidentally, many state governments have increased the VAT on petrol and diesel in the last one year. Maharashtra, for example, is one such state that increased VAT from 27 to 47 percent.

Earlier, between November 2014 and January 2016, the government had raised excise duty on petrol and diesel on nine occasions to take away gains arising from plummeting global oil prices.

However, it refused to cut the excise duty despite the sustained rise in fuel prices since July this year.

While the move may offer some respite to end-consumers, opposition parties were quick to accuse the Narendra Modi-led government of ‘fooling’ people.

“Modi government had increased excise duty on diesel from Rs 3.56 to Rs 17.33 and is now trying to fool people by reducing Rs 2 before Gujarat polls,” said senior Congress leader Arjun Modhwadia.