It takes 30 years for a household to buy a flat in Mumbai: Oxford Economics

Representational Image

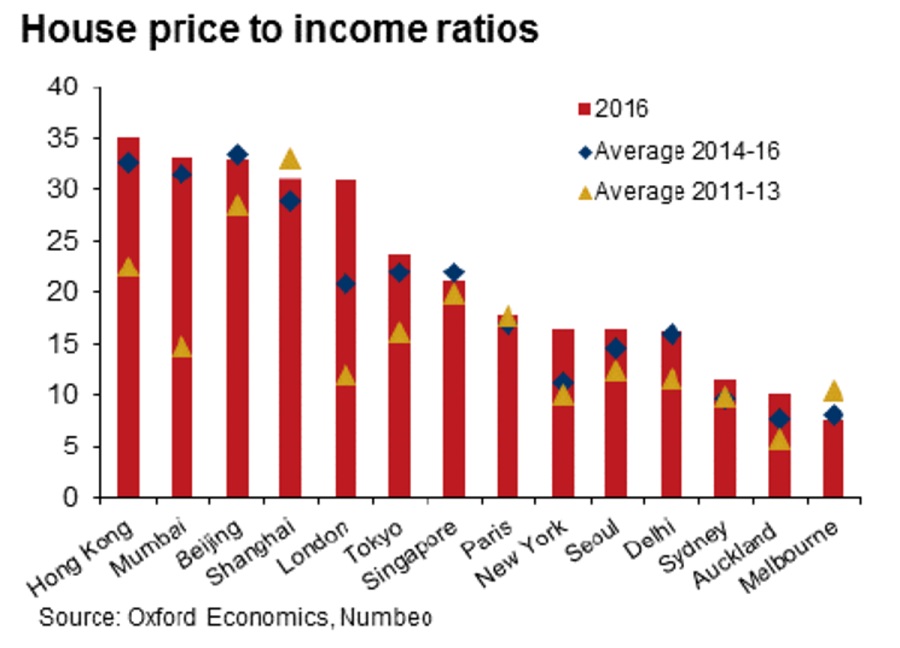

Contrary to popular belief, it is more expensive to buy a house in Asian cities like Mumbai and Hong Kong than their western counterparts like London or New York.

According to Oxford Economics’ examination of price-to-income ratios across the world, it now takes over 30 years for a household with local median income to buy a 90 square meter (970 square foot) apartment in cities like Hong Kong, Mumbai, Beijing and Shanghai.

However in all such cities, including Delhi, the return from rents is remarkably low.

A low rent typically implies that the overall valuations are inflated or stretched to an extent.

In all four cities, the gross rental yield was lower than 10 year government bond yields in 2016, unlike places such as Tokyo, Sydney, New York and Seoul.

“We expect housing price increases to moderate in the coming years across Asia, with outright falls possible in some markets,” economists Tianjie He and Louis Kuijs wrote in the report.

In addition to rising supply and efforts in some places to cool red-hot markets, changes in interest rates will also put downward pressure on prices.

The low interest rates in the last decade have reportedly helped fuel house price growth across the world, and the rise in rates in the U.S. and elsewhere will likely reverse that trend by making mortgages more expensive.

Further rate rises by the Federal Reserve may attract money back to the US, which would affect property prices in Asia.

While the rising prosperity and demand in many large Asian cities is expected to continue to support house prices, the demand for housing is expected to decline in cities like Tokyo and Seoul, where the population is likely to shrink in the next eight years.

With inputs from Bloomberg

Price to Income ratios of top cities