Explained: Tax exemption on income of Rs 5 lakh

The move explictly benefits those with net taxable income of Rs 5 lakh or less, while keeping the tax rates unchanged for those with higher income

As opposition parties were training their guns over lack of sops for the country’s burgeoning middle class, Finance Minister Piyush Goyal announced the hike in income tax exemption limit to Rs 5 lakh towards the end of Friday’s budget announcement.

“Individuals with income up to Rs 5 lakh will not be required to pay any tax,” Goyal said while presenting Interim Budget for 2019-20 in Lok Sabha.

With this, Goyal said, individuals who are earning gross income of Rs 6.5 lakh per year and have made investments in savings instruments, will be exempt from paying income tax.

“This will provide a benefit of Rs 18,500 to 3 crore middle-class taxpayers self-employed, senior citizens,” he said, adding the number of beneficiaries will go up for those who have made investments in mediclaim and pension.

The move explicitly benefits those with net taxable income of Rs 5 lakh or less, while keeping the tax rates unchanged for those with higher income.

Further, no tax will be deducted on interest earned on bank and post office deposits of up to Rs 40,000 annually, up from Rs 10,000 currently.

The Budget also proposed to exempt tax on notional rent for unsold housing units for two years.

Goyal also proposed that benefit of rollover of capital tax gains be increased from investment in one residential house to that in two residential houses, for a taxpayer having capital gains of up to Rs 2 crore.

However, it can be exercised once in a lifetime, he added.

The Income Tax department will move towards faceless assessment and verification of returns, Goyal announced.

Further, standard deduction has been raised from Rs 40,000 to Rs 50,000 which will benefit three crore salaried individuals, he said.

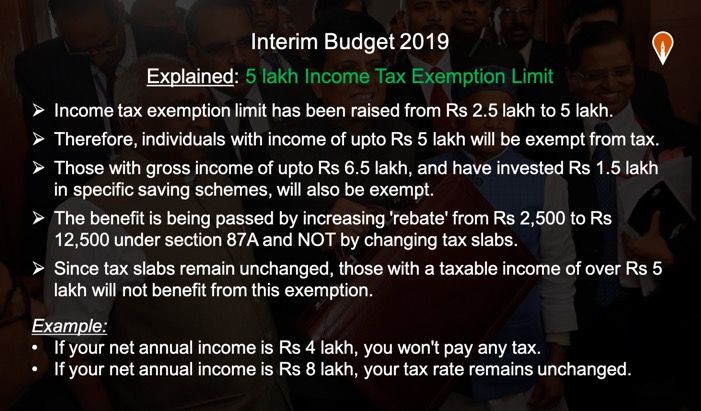

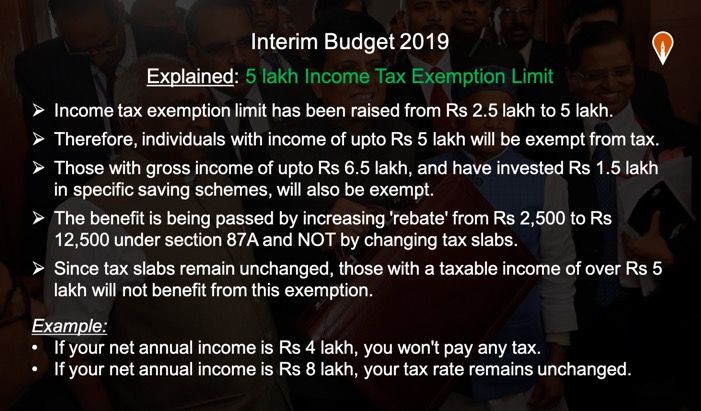

What the 5 lakh income tax exemption limit implies

* The Centre has increased the income tax exemption limit from Rs 2.5 lakh to Rs 5 lakh from the next fiscal.

* As a result, individuals with net income of up to Rs 5 lakh will be exempt from paying income tax.

* Individuals with net income of up to Rs 6.5 lakh, who have invested Rs 1.5 lakh in specific saving instruments, will also be exempt.

* The benefit is being passed by increasing ‘rebate’ from Rs 2,500 to Rs 12,500 under section 87A and not by changing tax slabs.

* Since tax slabs remain unchanged, those with a taxable income of over Rs 5 lakh will not get any benefit from this exemption.

Examples:

* If your net annual income is Rs 4 lakh, you won’t pay any tax.

* If your net annual income is Rs 8 lakh, your tax rate remains unchanged.

Note:

Existing tax slabs for individuals below 60 years are as follows:

* No tax for income between 0 and 2,50,000

* 5% tax for income between 2,50,0001 and 5,00,000

* 20% tax for income between 5,00,001 to 10,00,000

* 30% tax for income above 10,00,001