Mumbai Real Estate: New project launches down by 36%, sales by 8%

In Mumbai, new project launches declined by 36% while sales fell by 8% (Representational Image)

With the number of new project launches having fallen by 36 percent and sales of residential property down by 8 percent in the Mumbai Metropolitan Region, the post demonetisation lull period for the real estate sector has continued in the first half of 2017.

However, unlike last year, the decline in sales and new launches can be attributed to the roll out of Real Estate (Regulation and Development) Act (RERA) and the Bombay High Court’s stay on new projects over lack of dumping grounds in the city.

The data was released by Knight Frank India in a report titled ‘India Real Estate’ (January to June 2017). It was launched on Wednesday.

On the subject of declining sales and launches, the report said, “The Bombay High Court has stayed permissions to new projects over saturation of dumping grounds in Mumbai. RERA compliance also deterred builders from marketing their projects, thereby impacting residential sales.”

New launches in the city, which fell from 24,450 in January-June 2016 to 15,763 in the corresponding period in 2017, were hit harder than sales, which fell by 8 percent from 1,35,000 in 2016 to 1,20,755 in 2017.

Interestingly, most of the new launches were priced below Rs 50 lakh.

“On the price front, Mumbai, like other cities, is undergoing a time correction. Going forward, since Maharashtra is one of the frontrunners in having a RERA regulator in place, we believe that this city may come out of the hiccups of policy interventions soon,” Samantak Das, Chief Economist and National Director for Knight Frank India, said.

While the unsold inventory of 1,38,652 units remains a concern, lucrative offers by developers helped push sales in certain micro markets like Kalyan-Dombivali. However, it is estimated that developers will take over two years to clear all units.

Das added that the roll out of goods and service tax (GST) along with the new RERA regulations will help in regularising the sector and make it more attractive for everyone involved.

According to Shishir Baijal, Chairman and Managing Director of Knight Frank India, the declining sales don’t point to any market instability, instead they were a small price to pay for a more transparent sector.

“These were the corrective measures long due to transform real estate into a robust, transparent and thriving sector. The short-term hiccups the industry will eventually fade away and bear rich dividends in future,” he said.

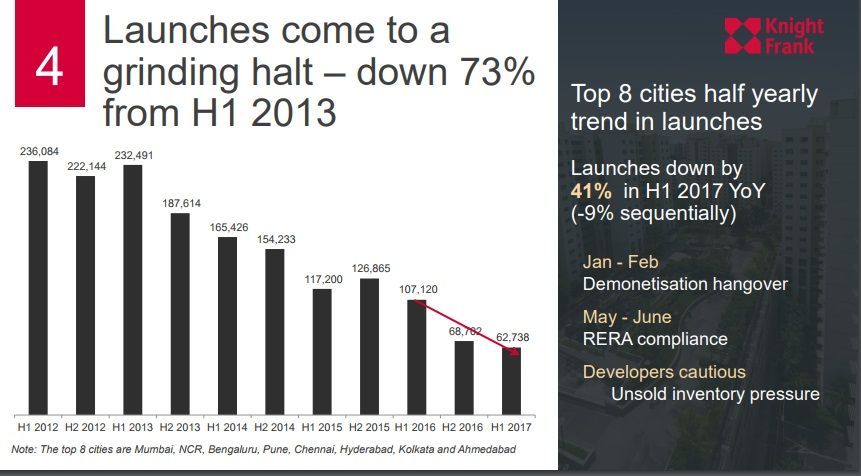

As for the top eight cities, which include Delhi, Bengaluru, Pune, Chennai, Hyderabad, Kolkata and Ahmedabad apart from Mumbai, the sales dropped by 11 percent and new launches fell by 41 percent, the report said.

The new launches have fallen drastically in the top 8 cities (Picture: Knight Frank India)