Starting today, both AC and non-AC restaurants to levy 5% GST on food bills

Both AC and non-AC restaurants will levy 5% GST on food bills (Representational Image)

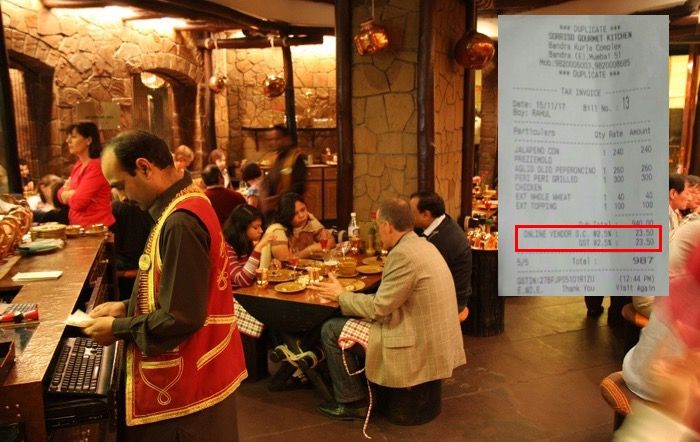

Expect to pay a tad less on food bills starting today, as the government’s decision to shift restaurants to a 5 percent bracket in the Goods and Services Tax comes into effect.

Earlier, since GST was introduced on July 1, air-conditioned restaurants levied 18 percent tax on food bills while non air-conditioned restaurants charged 12 percent.

However, from today, all restaurants outside high-end hotels charging over Rs 7,500 per room will uniformly levy GST of 5 percent. The revised rate will also be applicable on food delivery, whether it is made by the restaurant directly or via apps like Zomato or Swiggy.

Union Finance Minister Arun Jaitley announced the reduction in tax rates for hotels and other everyday items last week after chairing a two-day meeting of the GST council.

While lowering the tax rate, Jaitley announced that the facility of input tax credit for restaurants was being withdrawn as they did not passed on the benefit to consumers.

High-end hotels with rooms above Rs 7,500, however, will continue to levy 18 percent GST and enjoy the benefits of input credit.

While the reduction in tax is expected to benefit customers, it is likely that some restaurants – which diligently claimed offset on tax paid on inputs against tax paid to government – may increase prices to make up for the loss in tax credit on raw materials.

In a major revamp of the GST tax structure, the GST Council also removed 178 items from the highest 28 percent category.

“The GST Council has decided to slash tax slabs of 178 items from 28 percent to 18 percent. It will be applicable from November 15,” Jaitley had said.

After the change, only 50 products including luxury and sin items, white goods, cement and paints, automobile, aeroplane and yacht parts have been retained in the top 28 percent slab.

GST Council in its 23 Meeting at Guwahati,Assam on 10th November,2017 had taken a major decision to reduce the GST rates on more than 200 items falling in Goods Category: pic.twitter.com/nqNl0SsVId

— Ministry of Finance (@FinMinIndia) November 13, 2017

With the latest decisions, GST has been cut on a host of consumer items such as chocolates, chewing gum, shampoo, deodorant, shoe polish, detergents, nutrition drinks, marble and cosmetics.

Luxury goods such as washing machines and air conditioners have been retained at 28 percent.

Among mass consumption items watches, blade, stove, mattresses have been reduced to 18 percent from 28 percent. Rate on pasta, jute and cotton hand bags has been cut to 12 percent from 18 percent.

“13 items, which were earlier under 18 percent, have been brought down to 12 percent. Six goods have come down from the 18 percent slab to 5 percent, 8 items have come down from 12 percent to 5 percent and 6 items from 5 percent to zero tax,” Jaitley said.

The GST Council also made changes in return filing procedures to reduce the compliance burden for the small taxpayers. It decided that filing GSTR 3B would continuing till March 31, 2018.