Foodpanda 2.0: A tale of disgruntled delivery boys, annoyed customers & pertinent questions

A plethora of issues mar Ola-acquired Foodpanda as it takes on billion-dollar behemoths Zomato & Swiggy (Main Picture: Wikifeed)

Just nine months after Ola acquired Foodpanda to foray into the online food delivery market, the latter is faced with a barrage of problems including disgruntled delivery executives, recurring service lapses and negative word-of-mouth publicity.

The Acquisition:

In December 2017, ANI Technologies Pvt. Ltd, which operates Ola, acquired Foodpanda India from its German parent company Delivery Hero AG in an all-stock deal.

At the time of acquisition, the company announced that it would invest $200 million – over Rs 1,400 crores – in the platform to elevate its market presence.

The acquisition also paved way for Ola’s entry into the now ‘matured’ online food ordering and delivery business, where it’s rival Uber is slowly gaining momentum with UberEATs and billion-dollar behemoths like Zomato and Swiggy dominate the market.

For the uninitiated, this is not Ola’s first tryst with the online food delivery business. It had launched ‘Ola Cafe’ in Mumbai back in March 2015, but shut the service last year due to tepid response.

The Revival:

Following the acquisition, Foodpanda’s technology team started working on integrating the food delivery vertical with the existing Ola app to leverage on it’s 150 million-plus customer base.

Meanwhile, the service was launched in seven major cities – Bengaluru, Mumbai, New Delhi, Kolkata, Chennai, Hyderabad, and Pune.

Upon clearing the technical hurdles, Foodpanda announced its big comeback campaign ‘The Crave Party’ last month. The campaign entailed a number of exciting offers like Desserts at Rs 9, Snacks starting at Rs 19 and Biryani starting at Rs 79.

Foodpanda went all out to promote ‘The Crave Party’ campaign (Picture Courtesy: bestmediainfo.com)

In a bid to fulfil the orders and fuel expansion plans, the company recently announced that it was planning to recruit 60,000 delivery riders in the next two months.

The strategy for recruitment was simple – offer a substantially higher salary than anyone in the hyperlocal delivery business.

The Problems:

Foodpanda’s strategy for attracting more orders hit the bullseye, thanks to the enviable marketing budget at its disposal. However, the successful campaign inadvertently gave rise to three major problems.

A. Service Complaints

In a release issued earlier this month, Foodpanda said it was catering to 3 lakh orders per day – an impressive figure by all accounts, especially given how rapidly it reached there.

But, raking up orders could only win half the battle. The next, and most crucial, step was to fulfil them.

With users already accustomed to ordering from Zomato and Swiggy, market leaders with tonnes of experience and fine-tuned delivery processes, the expectations were high.

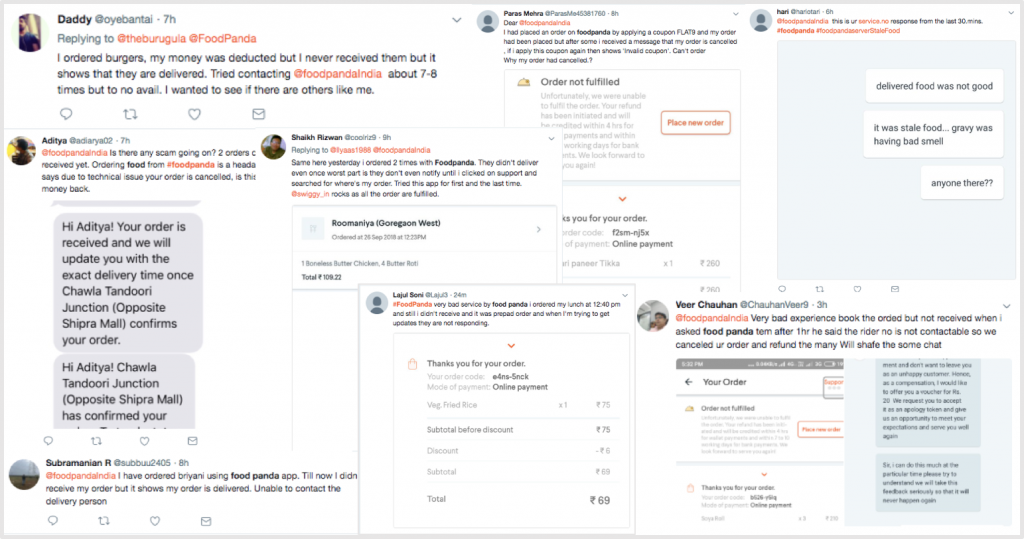

And that’s where the brand seems to be struggling. A cursory glance on Twitter alone shows over 30 complaints reported within a one hour period on Thursday evening.

The most common ones being:

Several customers complained about cancellations, delays and refunds online (via Twitter)

* Non-delivery – Several customers complained about their orders either not getting delivered or being marked ‘delivered’ in the app without every being sent over.

* Order cancellation – A number of users who tried to avail the ongoing offers saw their orders getting cancelled, in some cases repeatedly.

* Refund – In many cases, users complained about not receiving a refund days after their order was cancelled or not delivered.

* Support – While not entirely unique to Foodpanda, numerous customers have complained about not getting support from the customer care executives on call or chat.

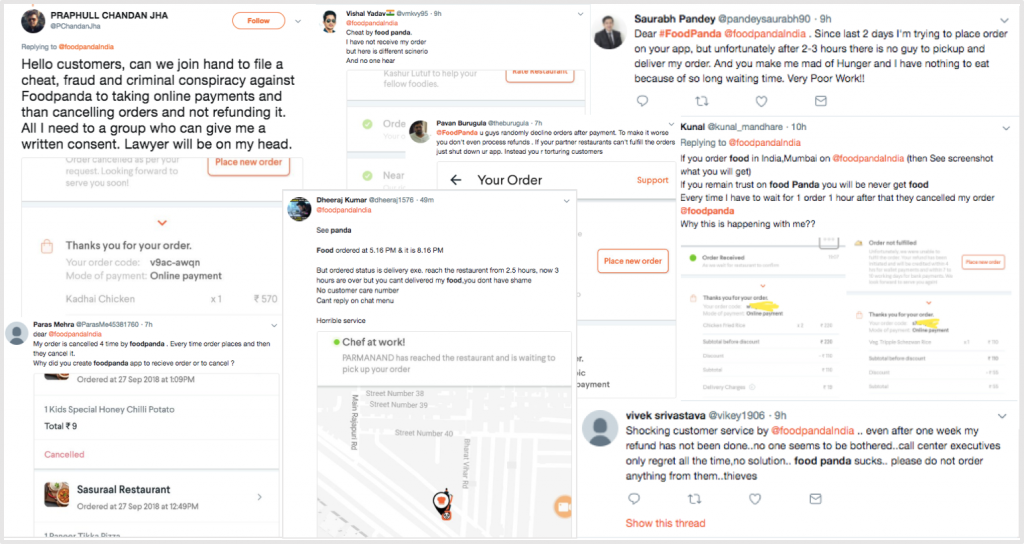

To their credit, the official Foodpanda handle was actively replying to complaining users. But, not everyone received a response.

The Foodpanda team was actively replying to complaining users, but not everyone got a response (via Twitter)

It also worth noting that the feed had comments from some happy customers too, who were visibly ecstatic with the comically low priced food and timely service.

B. Staff Woes

With no dearth of capital, Foodpanda hired delivery agents left, right and centre in anticipation of the business to come, and likely to disrupt the status quo.

During its initial hiring stint, the company promised a salary ranging between Rs 35,000 to 45,000 per month. The amount was extremely lucrative if one was switching from a competitor like Zomato or Swiggy, who were paying less for obvious reasons.

A weekly payout of roughly Rs 9,000 (and Rs 36,000 per month) was guaranteed if riders diligently showed up and logged in every day. There was potential to earn more for additional hours, more orders and the works.

The assurance of higher salaries had the desired effect and the company’s offices were thronged by thousands of job seekers. Many of them were hired before the ‘big’ campaign began, when the orders were limited or negligible.

It was the perfect job, requiring minimal effort and paying well, right until the day the salaries stopped or were cut down.

Over the last few weeks, delivery boys from every operational city have tried to reach out to the management to highlight their plight. Based on our conversations with three riders from Mumbai (Ahmed, Rehman & Ajay – whose last named have been withheld), their major grievances are:

* Less or no payment – Some riders have alleged that they are yet to receive salaries despite working for well over a month, while others claim that they got only a fraction of what was promised. In a handful cases, riders were paid under Rs 100 for a week’s work despite fulfilling the required quota of hours. The company had earlier said it could not process payments as many riders had given incorrect account information, a claim that riders have categorically denied.

* Salary revision – The company purportedly changed the salary structure overnight, reducing the daily payment limit from around Rs 1,300 to Rs 900 without giving any explanation. The amount has been lowered to the tune of around 500 now.

* Stopping incentives – A number of incentives that were promised at the time of recruitment, like one for sending pictures from their current location, have now been rescinded.

* Fewer hours – Riders also say that the company’s tally shows excruciatingly low work hours even after they had completed their stipulated time, in some cases showing just 2-4 hours instead of the 12 they were logged in for.

* No negotiation – The riders’ say their complaints have fallen on deaf ears as the employees they have access to don’t have the authority to make amends. Those who tried speaking to the management, on the other hand, have had more face time with bouncers than officials.

* No work for protestors – When some riders agitated and went on strike over the issues, riders from other locations were called to fill in for them. The ones who were protesting, meanwhile, were asked to either quit or threatened with termination.

Since individual riders were thwarted off easily, hundreds of riders banded together and staged protests outside Foodpanda’s, and in some cases Ola’s, offices throughout September to demand salaries. So far, protests have been held in Mumbai, Pune, Hyderabad, Bangalore, Chennai and Kolkata.

During earlier protests, slogans were raised, offices were forced shut and riders went on indefinite strikes. But, with no respite in sight, the riders have been nudged on to a more destructive route which entails forced entry, property damage and threatening staffers.

At least two such instances took place yesterday – one at Foodpanda’s office in Mumbai’s Andheri and the other in Kukatpally, Hyderabad.

Video from Andheri, Mumbai (Note: Video contains profanity, discretion advised)

It’s not as if the riders have not tried other means before setting out on their current path. In Mumbai, some riders tried to file a police complaint but were advised to ‘try and settle the matter with the company’.

Another faction approached Mumbai BJP vice-president Hyder Azam, who met Foodpanda executives earlier this week at the company’s headquarters in Andheri and promised a resolution in the next 10 days.

A separate group also met TV actor Ajaz Khan in a bid to garner support and possibly get some media attention.

On a separate note, the strategy of attracting job seekers with unrealistic salaries, bolstering its workforce and eventually reducing pay over time till it comes at par with the acceptable market rates is reminiscent of what Ola was accused of doing with its drivers a few years back. Even that culminated in pan-India protests by its driver partners.

Hundreds of delivery boys met Mumbai BJP vice-president Hyder Azam earlier this week, seeking his intervention in the matter

C. Partner Issues

Before the start of its campaign, Foodpanda executives left no stone unturned while pursuing restaurants in a bid to onboard them.

The cost-effective partnership, coupled with a known business model and aggressive marketing campaigns, ensured that a majority of restaurants were open to partnering.

But a month into the campaign, the service lapses on Foodpanda’s part have had a cascading effect on restaurant partners as well. Some say they are losing face in front of customers, while others claim that the company may have bit more than it can chew.

A restaurant chain, with several outlets in Mumbai and renowned for its Asian cuisine, faced major issues when the ‘crave party’ campaign kicked off as they had no clue about order volume.

The restaurant had signed on to offer a particular snack at Rs 19. On day one, it received hundreds of orders for it, taking them by surprise. Eventually, they were only able to fulfil about 10 percent of the orders, while cancelling the rest due to lack of preparation.

Needless to say, calls from a handful angry customers enquiring about their order didn’t help.

On the second day, when they were ready to handle the order size, Foodpanda’s app crashed and remained inaccessible for several hours, resulting in negligible orders. On day three, it managed to fulfil over 50 percent of orders but was forced to cancel the remaining ones.

Unfortunately, even out of the ones that were accepted, almost half were not delivered as no one showed up to take the order for delivery. A renowned bakery and patisserie chain had a similar experience.

Some eateries faced a completely different problem. For example, a delivery kitchen in BKC tied up with Foodpanda well before the start of the campaign. But the outlet was never made live on the app. When the owner tried reaching the representative who had pitched to him earlier, the executive remained unavailable – for days.

The owner of a popular Andheri-based burger joint shared why he wasn’t keen on jumping the bandwagon just yet.

“Foodpanda isn’t exactly reinventing the online food ordering space, nor is it carving a niche for itself. Its new customers are those who don’t want to miss out on a deal this good. Their stint with Foodpanda will only continue as long as the company is willing to bear losses and take a massive hit on every order. When the music stops and its time to test customer loyalty, established players with proven track records will always have an upper hand,” he told Local Press Co.

Response & Questions:

A message and email to Foodpanda, for a statement on the alleged non-payment of dues and service lapses, remains unanswered as of publishing this report.

Incidentally, the company on Thursday announced that it had started operations in 13 new cities as part of its expansion strategy, taking it tally to 20 cities. It also said it has boarded 5,000 additional delivery partners in these 13 cities to offer a seamless ordering experience.

As far as Foodpanda’s ambitions are concerned, the writing is on the wall. It will do anything it can to disrupt the market. But, recent developments raise three very pertinent questions which have far reaching effects on the company and the industry:

1. From an ethical viewpoint – Is Foodpanda’s incessant need to grow quickly, while knowingly withholding the payments of delivery boys, taking it back to its checkered past?

2. From a legal perspective – Should a company be allowed to skirt labour laws by changing payouts overnight or ‘hire & fire’ on a whim even when it comes to contactual employees?

3. From an industry standpoint – What happens to an industry’s intrinsic need for innovation if unsustainable discounts and unrealistic salaries become the de facto mantra for disrupting the market?