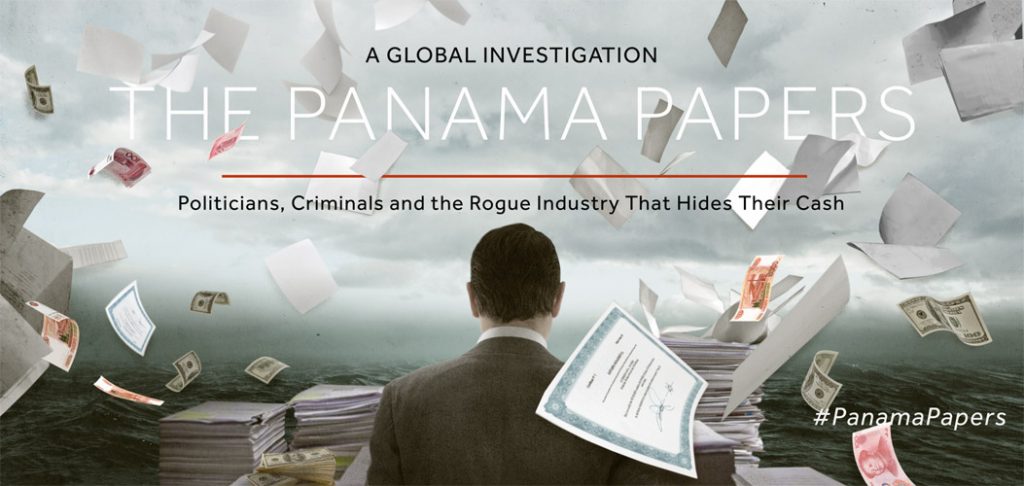

Panama Papers: A money laundering revelation 1500 times the size of WikiLeaks

Picture Courtesy: OCCRP.org

Unless you’ve been living under the rock for the last 24 hours, you must have come across or heard the term ‘Panama Papers’ – A massive document leak involving a host of global personalities.

Here’s a compilation of everything you need to know about Panama Papers.

What is ‘Panama Papers’ exactly?

A collection of 11.5 million confidential documents belonging to Panama-based law firm Mossack Fonseca, leaked to German newspaper Suddeutsche Zeitung.

What’s so special about Mossack Fonseca?

The firm specialises in incorporating companies in offshore tax havens such as Switzerland, Cyprus and the British Virgin Islands. Mossack Fonseca is the 4th largest provider of offshore services in the world, having incorporated over 300,000 companies till date.

How did the documents leak?

An anonymous source had sent the 2.6 terabyte of data to the German Newspaper over a year back.

Who investigated the documents?

German Paper Suddeutsche Zeitung shared the documents with the International Consortium of Investigative Journalists (ICIJ) and over 100 news organizations collectively sifted through the documents. Reporters from India based publication, Indian Express, was also a part of the investigating team.

The ‘Panama Papers’ investigation was the biggest cross-country journalism collaboration with over 370 journalists from over 100 media organizations teaming up.

Why are the documents so important?

The leaked documents show a vast web of offshore shell companies used by members of the global elite community to evade taxes, hoard money, and bypass economic sanctions.

The documents have already caused a ripple by exposing the offshore financial dealings of some of world’s most well renowned figures like Russian President Vladimir Putin, Chinese President Xi Jinping, Pakistan Prime Minister Nawaz Sharif, Ukrainian President Petro Poroshenko, Footballer Lionel Messi and Actor Jackie Chan.

With documents totalling to 2600 GB, compared to the Wikileaks’ 1.7 GB, the ‘Panama Papers’ is being touted as the biggest blow to illegal offshore business dealings till late.

Does everyone who own an offshore company a crook?

Nope. Setting up offshore companies is perfectly legal and there are plenty of legitimate reasons for setting up one. However, due to the anonymous company structure, many make use of offshore companies to launder money.

Are there any Indians listed in the leaked documents?

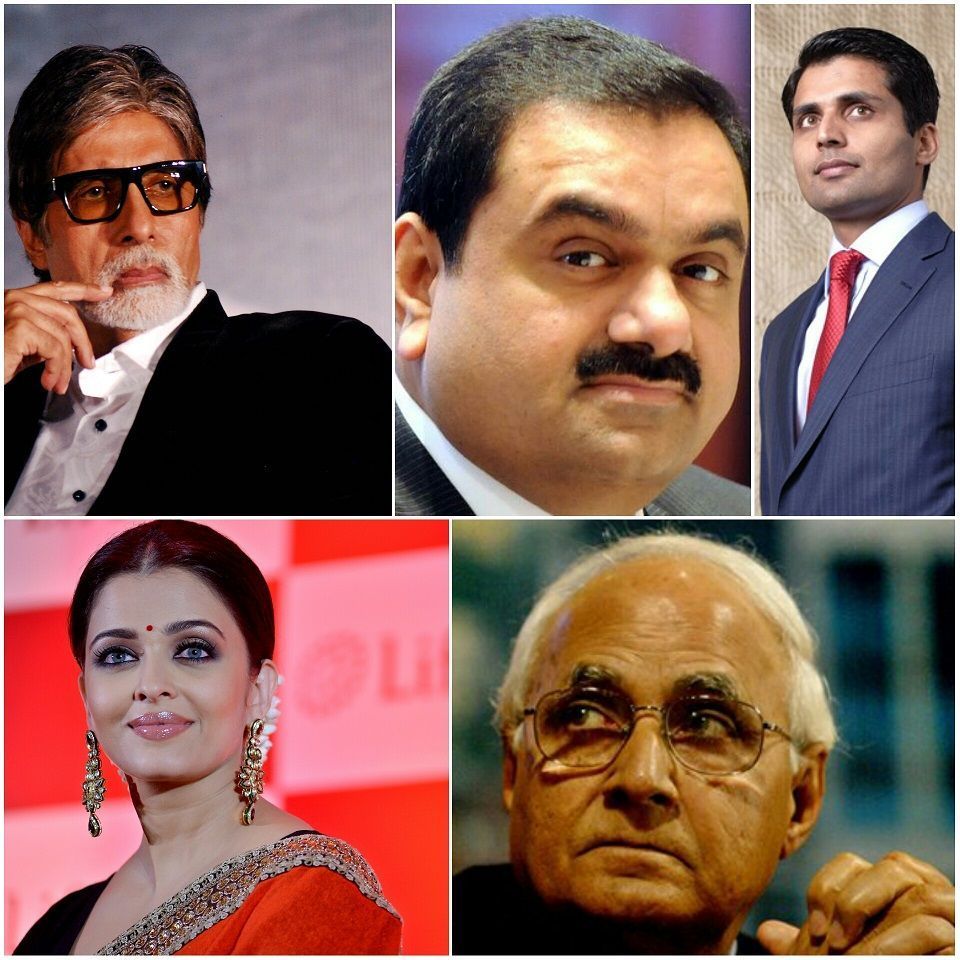

Over 500 Indians, including industrialists, politicians, underworld members and bollywood celebrities, feature on the list for owning an offshore companies, foundations and trusts.

Clockwise from top- Amitabh Bachchan, Gautam Adani, Sameer Gehlaut, K.P Singh and Aishwarya Rai Bachchan

Some of the famous names include: Actor Amitabh Bachchan, Indiabulls owner Sameer Gehlaut, DLF Promoter K.P Singh, Actress Aishwarya Rai Bachchan, Builder Gautam Adani, Political figures Anurag Kejriwal and Shishir Bajoria and late gangster Iqbal Mirchi.

In addition to individuals, there is evidence of companies setup by the Government and other corporations.

Can Indians legally set-up offshore companies?

Until the year 2003, Indians could not set-up offshore entities.

In 2004 RBI, for the first time, allowed Indians to send upto $25,000/year abroad. Only in the year 2013 did RBI allow Indians to setup subsidiaries or joint ventures abroad.

The Panama Papers, however, have exposed the business dealings of Indians prior to the year 2013.

What’s next?

The leak comes 6 months after the Government had allotted citizens a 90 day period for declaring any offshore assets and income under the ‘compliance scheme’. With the compliance window now closed, any individual found to have undisclosed foreign assets or income will face strict penalties and jail term.

With inputs from Indian Express’ article.