Patanjali may beat HUL to become the biggest FMCG brand in India by 2018-19

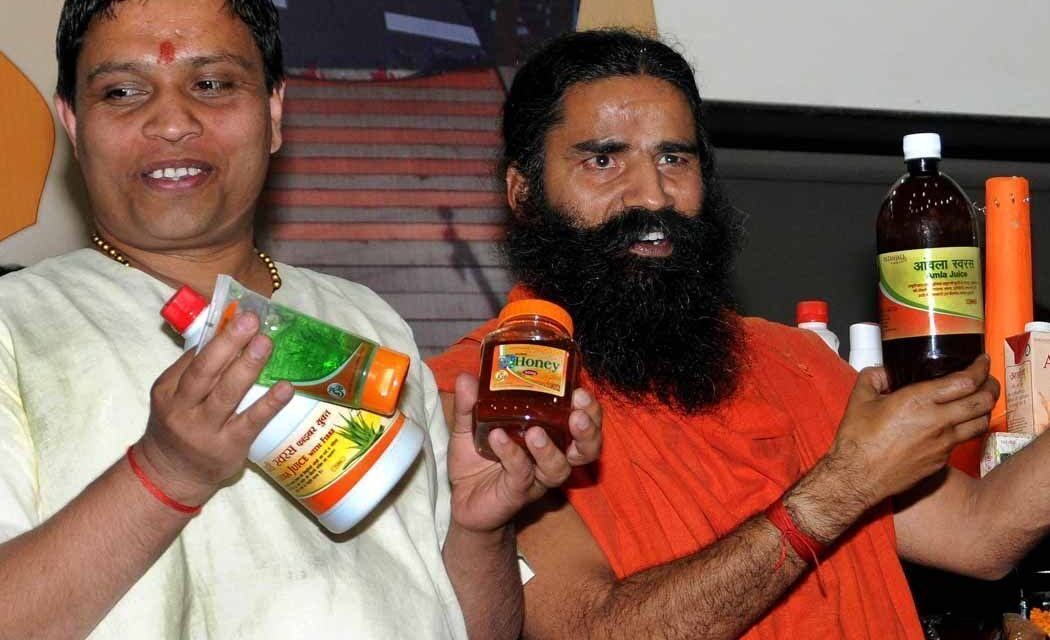

Acharya Balkrishnan and Baba Ramdev unveiling new Patanjali products

The Fast-Moving Consumer Goods (FMCG) market is amongst the most difficult markets to crack, especially in a country like India where there is no dearth of competition and conquering distribution remains an uphill task. But the Patanjali success story stands out as an exception to the rule.

Apart from it’s massive surge in year-on-year revenue, the herbal product brand has managed to achieve something that remains a distant dream for most FMCG behemoths – brand loyalty. While selling products at cheap rates isn’t exactly considered a pricing strategy, building an ever growing loyal customer base is a business strategy bar none. That’s exactly what Patanjali has managed to achieve.

Patanjali’s growth story has been covered time and time again. But, if we had to summarize it for you, the company’s revenues would be a good place to start.

# Turnover in 2011-12: Rs 446 crores

# Turnover in 2012-13: Rs 850 crore

# Turnover in 2013-14: Rs 1,200 crore

# Turnover in 2014-15: Rs 2,006 crore

# Turnover in 2015-16: Rs 5,000 crore

And the company has no plans of slowing down in 2016-17. In a press meet on Tuesday, the company’s founder Baba Ramdev said that the company is projecting a revenue of over Rs 10,000 crore in the current fiscal year. That’s a 100 percent increase for a company that is already churning out sales to the tune of Rs 5,000 crore.

He had projected a revenue of Rs 5,000 crore last year, and we know how that turned out.

If we use the company’s current growth rate to forecast its revenue for 2018-19, it would be a staggering Rs 40,000 crore. India’s biggest FMCG brand, Hindustan Unilever Limited (HUL), managed a sales turnover of Rs 32,721 crores in 2015-16 at a growth rate of around 10.7 percent. If we were to make a similar rudimentary projection for HUL for the year 2018-19, it would stand at approximately Rs 39,500 crores – Rs 500 crore less than Patanjali’s.

And that’s without taking into account Patanjali’s ever growing product line eating into HUL’s market share.

If you’re wondering how the yoga guru will keep doubling his sales year on year, his plans and projections for the fiscal 2016-17 gives us some insight:

# New Processing Units: Patanjali will be spending over Rs 1,000 crore on setting up new processing centers in Maharashtra, Assam, Madhya Pradesh, Rajasthan, Haryana and Uttar Pradesh. Four out of the six are expected to become functional within the year.

# E-commerce: The company is in talks with major e-commerce players for selling Patanjali products online. Although the company already sells the products via a handful niche sites, showcasing products on mainstream e-commerce website will be a game changer.

# Agricultural Produce: Patanjali currently purchases around 1,000 tonnes of wheat, barley, oats etc directly from farmers everyday. It plans on increasing the number ten-fold to 10,000 tonnes each day.

# Other Produce: Similarly, it purchases 500 tonnes of amla and aloe vera products everyday. That number is expected to increase to 1,000 tonnes.

# New Product Line: Patanjali will soon introduce dairy products like cheese, curd and a yoga apparel brand.

# Export: The company is planning on exporting honey and cosmetic products to over 10 countries this year. Exports will likely contribute 5 to 10 percent of its total revenue.

# Retail Outlets: Patanjali will add over 4,000 new distributors, 10,000 retail stores and 100 megastores by end of the year.

# Expansion: After FMCG, Patanjali will enter the education sector. Plans include setting up 500 new schools and a university.

# Research & Development: The company will spend a massive amount on linking its 1,200 clinics to an online system for gathering patient data. Apart from an online system, it will invest Rs 500 crores on research and improvement of the indigenous breeds of cows.

The numbers, in all honesty, are outrageously ambitious. But this is no ordinary Indian brand. It’s competing head to head with giants like Unilever, Colgate and Nestle, who’ve dominated the space since decades, and making them sweat.