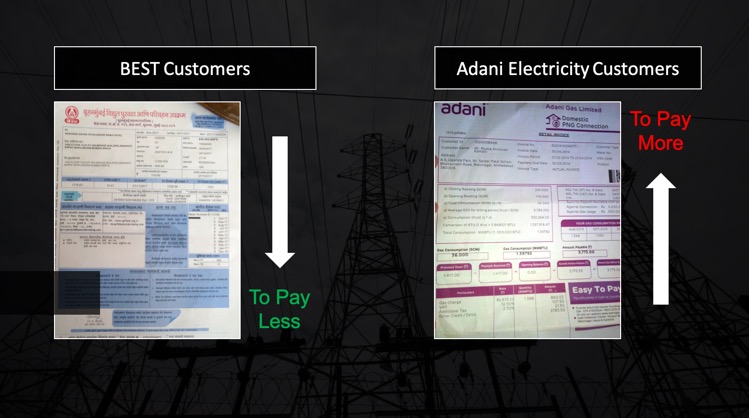

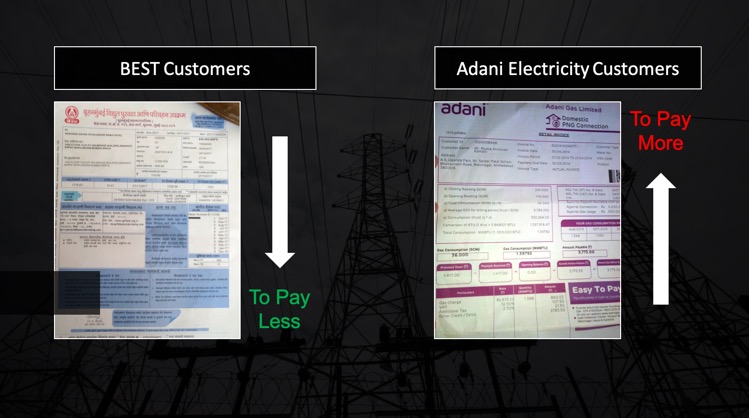

Electricity bills of BEST customers to go down, Adani consumers to pay more

BEST customers are likely to see a 2-3% decline in power tariffs while Adani Electricity customers will have to incur additional cost towards the recovery of regulatory asset charge

A vast majority of power consumers in the city will witness a change in their subsequent electricity bills, with BEST customers seeing a slight dip and Adani Electricity ones facing a marginal rise.

Relief for BEST customers

Earlier this week, Maharashtra Electricity Regulatory Commission (MERC) allowed the BEST to extend its existing power purchase agreement with Tata Power Co. Ltd. for five years.

Per the MERC order, the 677MW PPA will be extended from April 1, 2019 to March 31, 2024, on the existing terms and conditions. The power is supplied to BEST’s 10.5 lakh island city customers from TPC’s Trombay Thermal and Hydro plants.

The BEST had submitted to the MERC that continuing the existing arrangement with TPC would be the cheapest option before the distributor. It will reportedly purchase power at a lower rate of Rs 4.63 per unit from Tata.

The extension will ensure cheaper power to Mumbai consumers plus the advantage of hydro peaking power at the lowest rates in the country.

The MERC also allowed BEST to procure 100MW under the last bidding from Manikaran Power Ltd at a lower than average rate of Rs 3.94 per unit for five years.

The lower rate will allow BEST to drop its tariffs further. On average, the rates are expected to fall by around 2-3 percent for residential customers in the coming months.

Adani Electricity consumers to pay more

The customers of Adani Electricity Mumbai Limited (AEML), which took over Anil Ambani-led Reliance Infrastructure’s Mumbai energy business in a landmark Rs 18,800-crore deal in August last year, are expected to incur additional cost in the coming month.

The change comes in the backdrop of MERC allowing Adani Electricity to recover Rs 20.35 crore of regulatory asset charge (RAC) from its 25-lakh customer base, DNA reported.

At the time of the takeover, AEML had sought Rs 491.78 crore as RAC. However, due to some miscalculation during the mid-term review, an amount of Rs 491.78 crore was considered.

After the amount was reviewed, MERC allowed Adani Group to collect the remaining Rs 20.35 crore from customers in the current fiscal. As a result, customers will have to pay an additional Rs 80 – most likely in their next power bill.

The additional charge will further burden suburban consumers, who had to face a hike in September 2017 after the rates were revised.

Although the hike was approved by MERC while Reliance Infrastructure was still distributing electricity, the timing coincided with the Adani Electricity takeover, leading customers to believe that the company had increased rates.